When it comes to safeguarding your financial future, understanding the various Aflac policy types is crucial. Aflac, a leading supplemental insurance provider, offers a wide range of policies designed to protect you and your loved ones from unforeseen medical expenses and financial burdens. Whether you're looking for coverage for critical illnesses, accidents, or hospital stays, Aflac has tailored solutions to meet your needs. In this article, we’ll explore the different types of Aflac policies, their benefits, and how they can provide peace of mind during challenging times.

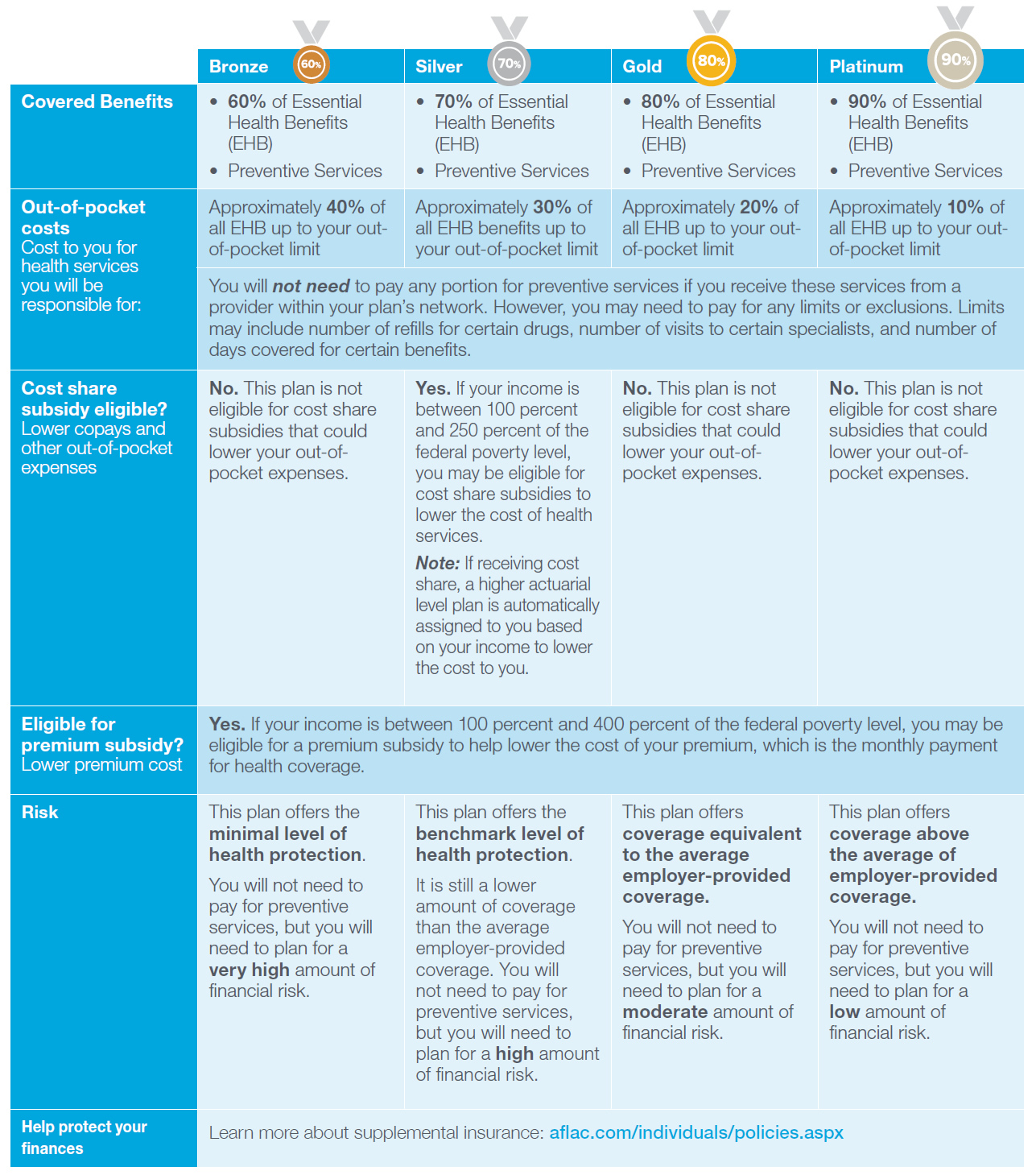

Supplemental insurance policies, like those offered by Aflac, are designed to complement your primary health insurance by covering expenses that traditional plans may not. These policies can help bridge the gap between what your primary insurance covers and what you actually need to maintain financial stability during a health crisis. By understanding the nuances of Aflac policy types, you can make informed decisions that align with your personal and financial goals.

As we delve deeper into this guide, you'll discover the intricacies of Aflac’s offerings, including accident insurance, cancer policies, hospital indemnity plans, and more. Each policy type is crafted to address specific needs, ensuring you have the right coverage when you need it most. By the end of this article, you’ll have a comprehensive understanding of Aflac policy types and how they can benefit you and your family.

Read also:How Old Is Aly Myler Unveiling The Age And Life Of The Rising Tiktok Star

Table of Contents

Introduction to Aflac

Aflac, short for American Family Life Assurance Company, is a globally recognized provider of supplemental insurance products. Founded in 1955, Aflac has grown to become one of the most trusted names in the insurance industry, offering policies that provide financial protection beyond traditional health insurance. Aflac’s mission is to provide policyholders with peace of mind by offering customizable coverage options that address specific health and financial concerns.

The company’s unique approach to insurance involves paying policyholders directly, rather than reimbursing medical providers. This means that Aflac policyholders receive cash benefits that can be used to cover out-of-pocket expenses, such as deductibles, copayments, or even everyday living costs during a medical emergency. This flexibility sets Aflac apart from other insurance providers and makes its policies highly appealing to individuals and families seeking additional financial security.

With a strong focus on customer satisfaction and financial stability, Aflac has earned numerous accolades over the years. The company is consistently ranked as one of the most ethical companies in the world, reflecting its commitment to transparency, trustworthiness, and ethical business practices. Understanding Aflac’s history and values provides a solid foundation for exploring the various policy types it offers.

Types of Aflac Policies

Aflac offers a diverse range of policy types, each designed to address specific needs and concerns. Below, we’ll explore the most popular Aflac policy types, including accident insurance, cancer policies, hospital indemnity plans, critical illness coverage, and more. These policies are tailored to provide financial protection during unexpected medical events, ensuring that policyholders can focus on recovery without worrying about financial strain.

Accident Insurance

Accident insurance is one of the most popular Aflac policy types, offering financial protection in the event of accidental injuries. This type of policy provides cash benefits for covered accidents, including fractures, dislocations, and burns. The benefits can be used to cover medical expenses, transportation costs, or even household bills while you recover.

- Coverage for Hospital Stays: Accident insurance often includes benefits for hospital confinement, emergency room visits, and ambulance services.

- Flexible Benefit Options: Policyholders can choose from various coverage levels to suit their needs and budget.

- No Network Restrictions: Unlike traditional health insurance, Aflac accident insurance pays benefits regardless of where you receive treatment.

Cancer Protection Policies

Cancer protection policies are specifically designed to provide financial assistance to individuals diagnosed with cancer. These policies offer lump-sum payments and ongoing benefits to help cover treatment costs, travel expenses, and lost income during treatment. Aflac’s cancer policies are a lifeline for families facing the financial burden of a cancer diagnosis.

Read also:Doc Net Worth Unveiling The Financial Success Of A Remarkable Personality

- Lump-Sum Payment: Upon diagnosis, policyholders receive a one-time payment to help with immediate expenses.

- Benefits for Treatment: Coverage includes benefits for chemotherapy, radiation, surgery, and other cancer-related treatments.

- Additional Support: Some policies offer wellness benefits, such as screenings and preventive care.

Hospital Indemnity Plans

Hospital indemnity plans provide cash benefits for covered hospital stays, helping policyholders manage the costs associated with inpatient care. These plans are particularly valuable for individuals who may face high deductibles or out-of-pocket expenses under their primary health insurance.

- Daily Cash Benefits: Policyholders receive a fixed amount for each day spent in the hospital.

- Coverage for ICU Stays: Higher benefits are typically available for intensive care unit stays.

- Supplemental to Health Insurance: Hospital indemnity plans work alongside traditional health insurance to provide additional financial support.

Critical Illness Coverage

Critical illness coverage is designed to provide financial protection in the event of a serious medical condition, such as a heart attack, stroke, or organ transplant. These policies offer lump-sum payments that can be used to cover medical expenses, mortgage payments, or other financial obligations.

- One-Time Payment: Policyholders receive a lump-sum payment upon diagnosis of a covered critical illness.

- Flexible Use of Funds: Benefits can be used for any purpose, including medical bills, travel, or household expenses.

- Peace of Mind: Critical illness coverage alleviates the financial stress associated with serious health conditions.

Disability Income Protection

Disability income protection policies provide financial assistance to individuals who are unable to work due to a covered injury or illness. These policies offer monthly cash benefits to help replace lost income, ensuring that policyholders can continue to meet their financial obligations during periods of disability.

- Monthly Cash Benefits: Policyholders receive a fixed amount each month to cover living expenses.

- Short-Term and Long-Term Options: Aflac offers both short-term and long-term disability coverage to suit different needs.

- Supplemental to Employer Plans: Disability income protection can be used to enhance existing employer-sponsored disability benefits.

Dental and Vision Plans

Aflac’s dental and vision plans provide comprehensive coverage for routine and preventive care, as well as major dental and vision procedures. These policies are an excellent way to ensure that you and your family maintain good oral and eye health without incurring high out-of-pocket costs.

- Coverage for Routine Care: Benefits include cleanings, exams, and preventive treatments.

- Discounts on Major Procedures: Policyholders receive discounts on crowns, root canals, and vision surgeries.

- Family Coverage Options: Aflac offers plans that cover entire families at affordable rates.

Life Insurance Options

Aflac offers a variety of life insurance options, including term life and whole life policies. These policies provide financial protection for your loved ones in the event of your passing, ensuring that they are taken care of financially.

- Term Life Insurance: Provides coverage for a specified period, typically 10, 20, or 30 years.

- Whole Life Insurance: Offers lifelong coverage with a cash value component that grows over time.

- Customizable Plans: Policyholders can choose from various coverage amounts and riders to suit their needs.

Choosing the Right Policy for You

Selecting the right Aflac policy requires careful consideration of your personal and financial needs. Begin by assessing your current health insurance coverage and identifying any gaps that need to be addressed. For example, if your primary insurance has high deductibles, a hospital indemnity plan or accident insurance may be beneficial.

It’s also important to consider your family’s medical history and potential risks. If cancer or critical illnesses run in your family, a cancer protection policy or critical illness coverage may provide valuable peace of mind. Additionally, evaluate your budget to ensure that the policy you choose is affordable and sustainable in the long term.

Consulting with an Aflac insurance agent can help you navigate the available options and tailor a policy to your specific needs. A licensed agent can provide personalized recommendations and answer any questions you may have about Aflac policy types.

Conclusion

Aflac policy types offer a wide range of supplemental insurance options designed to provide financial protection during unexpected medical events. From accident insurance and cancer policies to hospital indemnity plans and life insurance, Aflac’s offerings are tailored to meet the diverse needs of individuals and families. By understanding the benefits and features of each policy type, you can make informed decisions that align with your personal and financial goals.

We encourage you to take the next step in securing your financial future by exploring Aflac’s policy options. Whether you’re looking for additional coverage for accidents, critical illnesses, or hospital stays, Aflac has a solution that can provide peace of mind. Share this article with friends and family who may benefit from learning about Aflac policy types, and leave a comment below to share your thoughts or ask questions!